Wyoming Credit: Protect and Reliable Financial Solutions

Wyoming Credit: Protect and Reliable Financial Solutions

Blog Article

Transform Your Financial Future With Credit Scores Unions

Lending institution have been obtaining focus as trustworthy monetary organizations that can favorably affect your economic future. Their distinct structure and member-focused technique supply a variety of advantages that typical financial institutions may not supply. By welcoming the worths of neighborhood, partnership, and financial empowerment, lending institution offer a fascinating alternative for people aiming to improve their economic health. As we check out the numerous means lending institution can assist you attain your financial goals, you'll discover exactly how these establishments attract attention in the monetary landscape and why they could be the secret to changing your future financial success - Credit Union Cheyenne.

Benefits of Signing Up With a Cooperative Credit Union

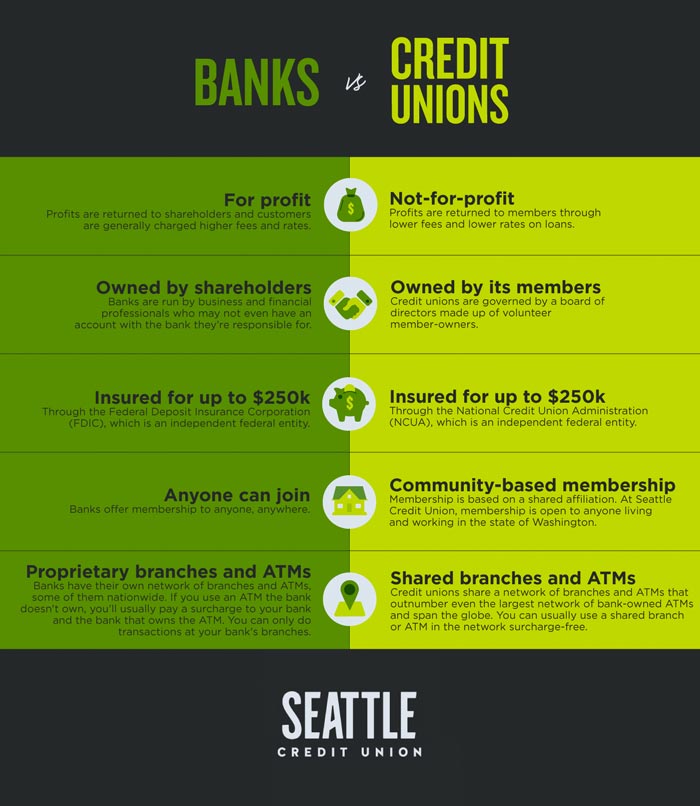

Joining a lending institution offers many benefits that can favorably influence your economic health. One of the main benefits is typically lower costs contrasted to typical banks. Cooperative credit union are understood for having reduced account upkeep costs, reduced over-limit charges, and commonly reduced rate of interest on lendings and bank card. In addition, cooperative credit union are member-owned, not-for-profit banks, which indicates they are concentrated on offering their members as opposed to creating revenues for investors. This member-centric strategy frequently translates right into better customer care, even more individualized interest, and a greater desire to work with members who might be experiencing economic difficulties.

In addition, cooperative credit union have a tendency to use affordable rate of interest on interest-bearing accounts and deposit slips. This can help participants grow their savings over time a lot more efficiently than if they were making use of a traditional financial institution. Several cooperative credit union likewise offer accessibility to financial education and learning resources, aiding members improve their financial literacy and make even more enlightened choices regarding their cash. On the whole, joining a cooperative credit union can be a smart relocation for people aiming to boost their financial wellness.

Cost Savings Opportunities for Participants

When considering monetary establishments that focus on participant benefits and provide advantageous rates and services, cooperative credit union attract attention as service providers of significant financial savings chances for their participants. Lending institution generally provide greater rate of interest on financial savings accounts contrasted to standard financial institutions, permitting members to gain much more on their deposits. In addition, several credit scores unions offer numerous cost savings products such as certificates of deposit (CDs) with affordable prices and terms, assisting members grow their cost savings better.

An additional financial savings opportunity cooperative credit union provide is reduced charges. Lending institution are known for billing fewer and lower costs than banks, resulting in price savings for their participants. Whether it's reduced account maintenance charges, atm machine charges, or overdraft account charges, cooperative credit union make every effort to keep costs marginal, ultimately benefiting their members.

Furthermore, credit scores unions typically provide economic education and therapy solutions to aid participants boost their economic literacy and make better saving decisions. By supplying these sources, cooperative credit union encourage their members to achieve their savings goals and secure their economic futures - Credit Union in Cheyenne Wyoming. Generally, lending institution present a series of savings possibilities that can substantially benefit their members' financial well-being

Lending Institution Loans and Fees

Credit rating unions' competitive car loan offerings and favorable passion prices make them a preferable option for participants looking for economic aid. Credit unions give numerous kinds of fundings, consisting of personal car loans, automobile loans, mortgages, and credit rating cards.

With reduced operating expenses contrasted to banks, credit rating unions can pass on the financial savings to their members in the form of decreased interest rates on car loans. Furthermore, credit rating unions are known for their personalized technique to lending, taking into account the individual's credit report history and financial situation to provide affordable rates customized to their needs.

Building Credit Score With Lending Institution

To establish a solid credit scores background and enhance economic standing, dealing with credit score unions can be a advantageous and critical method. Debt unions offer various services and products developed to assist members build credit history properly. One crucial benefit of using lending institution for developing credit history is their focus on personalized service and participant fulfillment.

Cooperative credit union normally give credit-builder fundings, secured credit report cards, and monetary education and learning sources to aid members in establishing or repairing their debt profiles. These products are created to be extra inexpensive and obtainable contrasted to those offered by typical advice banks. By making prompt settlements on credit-builder finances or secured bank card, individuals can demonstrate creditworthiness and boost their credit report over time.

In addition, cooperative credit union typically take a more all natural approach when examining credit history applications, thinking about factors past simply credit rating. This can be especially valuable for individuals with restricted credit report or previous financial challenges. By partnering with a cooperative credit union and sensibly utilizing their credit-building products, people can lay a strong structure for a protected monetary future.

Preparation for a Secure Financial Future

Another secret element of preparing for a safe and secure financial future is developing a reserve. Establishing aside three to six months' worth of living expenditures in an easily easily accessible account can give a financial safeguard in situation of unanticipated events like job check loss or medical emergency situations.

In addition to saving for emergencies, it is essential to consider lasting economic goals such as retirement. Adding to pension like a 401(k) or IRA can assist you secure your financial future past your functioning years.

Conclusion

Furthermore, credit score unions are recognized for their individualized method to loaning, taking right into account the person's credit background and monetary scenario to use affordable prices tailored to their requirements.To establish a solid credit score history and boost monetary standing, functioning with credit scores unions can be a strategic and advantageous strategy. Credit unions use different items and services designed to aid members build credit history responsibly.Credit unions normally supply credit-builder loans, safeguarded credit score cards, and economic education sources to help participants in establishing or repairing their credit history accounts.Moreover, debt unions frequently take a more all natural method when examining credit rating applications, thinking about factors past just credit score scores.

Report this page